Insurers have to use very precise language in their policies to make sure they stand up to legal scrutiny. But as many of these terms are unfamiliar, they can end up meaning next to nothing to the average reader. We’ve decoded all the lingo commonly used in the world of insurance, so you don’t have to.

We’re not fans of needless complications. We’ve written our policy documents in plain english and we measure how far you drive so we can price your insurance by the mile. It couldn’t be simpler. And everybody loves simplicity. Don’t they?

Perhaps not always when it comes to language. Walk into a coffee shop with your eyes closed and you could be forgiven for thinking you’d stumbled into a seminar on obscure renaissance music. (We thought Venti Cortado wrote string quartets, but it turns out it’s just a hot, frothy drink…).

In a world where you need to be bilingual to order your morning caffeine fix, it probably shouldn’t come as a surprise that car insurance which – let’s be honest – has a lot more to it, comes with its fair share of specialist terminology.

That’s why we try our best to make sure that all our documentation is a straightforward read. But we do still need to use a fair bit of the standard insurance vocab.

Never fear, though. With this jargon-busting A to Z to hand, the world of insurance will be clearer than a Starbucks menu in no time.

A

Act of God

Insurance documents will often talk about covering ‘acts of god’. This isn’t because insurers are worried about divine forces conspiring to get you into a prang. It refers to what you might think of as forces of nature – events like tornadoes, tidal waves and earthquakes.

More broadly, anything that lies out of human control can be considered an ‘act of god’ (as far as your insurance is considered, anyway).

Admin fees

Many insurers charge you to make changes to your policy. If you get a new job, for example, some companies will have the nerve to charge you a big fee – often upwards of £20 – to change the title on your policy.

Sound ridiculous? We think so too. At By Miles, we give you three policy changes each year, without charging any admin fees. It’s worth noting that as with any insurer, changes to your policy may result in an increase to your fixed annual amount and per-mile rate, also known as additional premiums.

Additional premium

This is an extra charge that comes about following a change to your policy.

For example, you might have made modifications to your car or added a less experienced named driver. If you do, then your insurer will probably charge you more, i.e. the ‘Additional premium’, to cover the extra risk.

Annual mileage

This is the number of miles you’re expecting to drive in a year. As a pay-by-mile insurance provider we don’t use this estimate for anything other than giving you an approximate idea of what your annual costs could be.

From what we’ve seen, most insurers don’t do much with your estimated annual mileage, even though it has a huge impact on your risk!

Approved repairer

If your insurer is paying to repair to your car, they’ll want to know the work is being done by someone they trust and not some jack of all trades. For that reason, they’ll have a list of approved repairers you can turn to. Using them often involves an upside for everyone involved…

For instance, the repairer might offer the insurer a discount on the work (given that they have a pre-existing relationship). They might also offer to pick up your vehicle, start work sooner than usual or throw in some other perks.

Insurers can’t force you to use their approved repairers if you don’t want to, but you might lose some entitlements if you go elsewhere (e.g. your right to a ), and you might have to pay a larger excess.

Auto-renewal

Auto-renewal essentially prevents you from driving without cover after the end of your policy.

Unless you give your insurer notice that you want to end your policy, your insurance will automatically renew once the contract is up.

While this is convenient as it stops you breaking the law, it can also mean you might miss out on the opportunity to save money by going elsewhere. So it pays to be organised and keep an eye on your renewal date, you don’t want to sleepwalk into an expensive new contract.

Don’t forget, you’ll always have the right to cancel any new policy within 14 days (see cooling-off period below!)

B

Black box

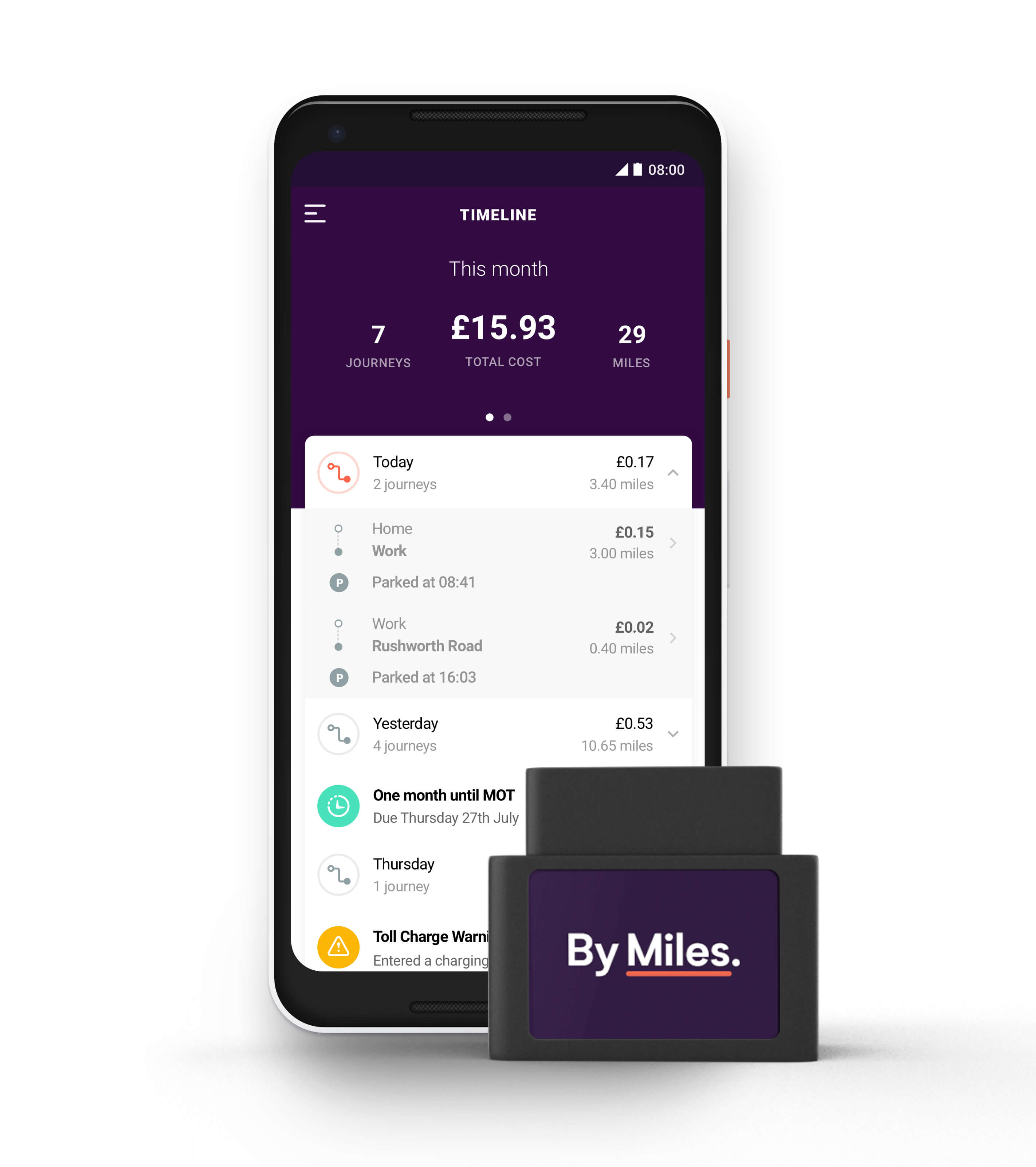

Telematics devices, such as our Miles Tracker, are sometimes referred to as ‘black boxes’ (though ours is definitely a lot more discreet than the chunky black monstrosities people normally think of when they hear the term).

If you take out a ‘black box’ policy, you need to get one one of these devices fitted (or if you’re with us, you can simply plug it in yourself) to your car. It feeds information back to your insurer that will help them price your premium more accurately.

Some insurers use black box technology to charge insurance premiums based on the way you drive, but at By Miles we prefer to base our premiums on how far you drive instead.

You can find out more about black box insurance policies, and what makes By Miles different, in this article.

The “Miles Tracker” is about the size of a matchbox.

Breakdown cover

The exact term may differ from insurer to insurer, but if your policy includes breakdown cover (or you’ve purchased it as an added extra) this covers the cost if your car conks out and you need to call for help.

Again, it depends on your particular policy, but if your car can’t be fixed at the side of the road, the cost of having it towed to a garage may be covered too.

Insurers don’t usually include breakdown cover as standard – so if you want it, you’ll probably have to add it to your policy.

By Miles gives customers the optional add-on of breakdown cover from the UK’s most experienced breakdown service, the RAC.

Business usage vs commercial usage

What you do with your car plays a big role in determining your premiums. As a result, policies may cover you for some kinds of driving activities, but not for others.

For example, it’s common for insurers to allow ‘business usage’ but not ‘commercial usage’.

At By Miles, we include cover for business use as standard for the main driver on a policy wherever we can, but that doesn’t include commercial use.

What’s the difference? Business usage is driving that’s connected to your work (driving to a work meeting, for example).

Commercial usage is where the driving is your work – something most policies don’t cover. So, if you’re delivering takeaways, running a taxi service or racing milk floats, you’ll need to look for specialist cover.

Get specialist ‘commercial’ cover if driving is your work.

C

Certificate of Insurance

You need proof that you’re insured – and that’s just what your Certificate of Insurance provides. Some insurers will give you a paper copy, others send it digitally.

Given that nobody likes filing and most of us like trees, at By Miles we’ve gone down the totally paperless route so we’ll email you everything you need – or you can access it all in our app.

Cancellation fee

If your insurance policy gets cancelled before the end date, insurers usually need to charge a cancellation fee to cover their costs.

This can get much heftier when it’s been more than 14 days since you bought your policy, so watch out for the fee going up after that time period.

At By Miles, our costs don’t change suddenly after two weeks (and we’re sure they don’t for other insurers, too), so we charge a flat cancellation fee, even if you’re outside the 14-day cooling-off period.

Capped mileage

We charge for our insurance on a per-mile basis, which strikes our members as a fairer way of doing things.

At the same time, we don’t want to penalise you for visiting your friends and family at the other end of the country.

We cap the number of miles you can be charged for at 150 a day and we’ll never charge you for more than that.

We’ll never charge you for more than 10,000 miles in a year either.

Claims and losses

‘Loss’ here doesn’t refer to you misplacing your car – besides, that’s something the ‘Find My Car’ tool in our app can help you avoid.

In this case, it means losing the use of something (e.g. not be being able to drive your car because the engine has failed) or losing out financially (e.g. having to pay for repairs to your car because someone dented it or having to replace your car as it’s been stolen).

A claim is where you let the insurer know about the loss so they can put things right. Obviously, they’ll only do so if the loss in question is covered in your policy.

Claims history

This is kind of like your insurance CV. It documents all the claims you’ve made and insurers will look at it when considering whether to accept you as a customer or setting your premiums. Unlike a CV, the less you have on it, the better…

Cooling-off period

Sometimes you buy something only to later realise it’s not quite right. In the case of a bright floral Hawaiian shirt, you can always take it back to the shop.

As insurance is a form of contract, things aren’t always so easy. So, to protect people from getting tied into a product they don’t really want or need, the law in the UK states that all insurance comes with a cooling-off period of at least 14 days.

During this time, if the customer changes their mind, they can cancel. It’s worth bearing in mind that you’ll almost always be charged a cancellation fee though, even if you’re still within the cooling off period.

Photo by Alessio Lin on Pexels

Courtesy car

Sometimes known as a temporary replacement vehicle.

If your ride is off the road, some insurers will provide an alternative car you can use in the meantime.

We don’t like the thought of our members having to hitchhike to work, so at By Miles we provide a temporary replacement car with every policy as standard.

Common law

This is one of the most commonly misunderstood options in the ‘relationship to main driver’ section of car insurance quote forms.

Provided you’re both adults, a ‘common law partner’ is basically someone you have a relationship with who’s been living at the same address as you for 6 months or more. It doesn’t matter what gender you both are, but it is different to a civil partnership.

From Sunday roasts to bad jokes in Christmas crackers, we love a good tradition in the UK. In fact, if a custom goes on long enough it can often end up enshrined in law.

That’s basically all common law is – a recognition that certain practices deserve legal status, even if they aren’t covered by a specific statute.

Cover note

If you haven’t received your Certificate of Insurance yet, this can be used in its place for a short time. And, unlike a note from your mum, it’s considered legally valid proof of insurance.

We don’t issue these as we give you a Certificate instantly, but you might get one of these at an old fashioned high street insurance broker.

Comprehensive insurance

As the name suggests, comprehensive insurance is pretty, well, comprehensive.

While you’d need to check your policy documents for a more detailed description of what’s covered by your specific policy, ‘fully comp’ policies often cover:

- Your car (against accidents, vandalism, fire or theft)

- Your car’s contents (against accidents, vandalism, fire or theft)

- Damage to your windscreen

- Medical costs following an accident

- Injury to any passengers or damage to property in your car

- Driving in certain countries outside of the UK (though this cover is pretty basic)

The alternatives to “comprehensive” are “third party, fire and theft” and the even rarer “third party only”. Don’t forget, even with fully comp insurance, if you make a claim, you’ll still have to pay your ‘excess’.

At By Miles, we only offer fully comprehensive insurance. Have a read of our policy handbook if you want to find out more.

D

DOC

DOC stands for ‘Driving Other Cars’. If DOC is included in your policy, you’ll have some level of cover when driving a car other than yours – but only in certain circumstances. Often, DOC will only apply if you were forced to drive the car in question due to an emergency.

Whatever the specifics, you can be sure that DOC won’t allow you to jump behind the wheel of any car that takes your fancy and remain covered, so make sure you’ve checked your policy documents before doing it.

E

Endorsement

Unlike celebrity endorsements, insurance endorsements aren’t anything to do with using your fame to sell products of questionable quality.

In fact, they aren’t really endorsements at all – they’re simply alterations to the terms of your policy. (‘Amendment’ would have been a better word, but here we are…)

Insurers don’t like customising their Policy Documents for each customer, so they use Endorsements to make bits of the Policy Document turn on or off.

Excess (compulsory and voluntary)

If you make an insurance claim, you’ll have to cover a portion of the cost out of your own pocket. This amount is called the ‘excess’.

A ‘compulsory excess’ is set by the insurer and you’ll have to contribute at least this much anytime you want to make a claim. However, you may have the option of choosing to increase your excess (that’s where the voluntary part comes in).

Why would you want to do that? Well, it’s a trade-off. If you choose to increase your excess, your insurer will lower your premium – the downside being that, if something does go wrong, it’ll cost more to claim.

If you set your excess excessively high (forgive the pun) you may end up in a situation where it’d be too expensive use your insurance even if you needed to, which kind of defeats the purpose.

At By Miles we keep it simple, and you just set your total excess when you get your quote, so you don’t have to mess around trying to remember two different numbers.

Ex-gratia payment

As you might have already guessed, ‘ex gratia’ is Latin. (In 2,000 years our ancestors on Mars will probably still be contending with ancient Roman terms in their space shuttle insurance…).

‘Ex gratia’ means ‘from grace’, although a better translation might be ‘out of the kindness of our hearts’. An ‘ex-gratia’ pay-out is one the insurer makes despite not being legally obliged to.

F

Fault and no-fault claims

This one seems seams easy doesn’t it? Surely a no-fault claim is where the incident wasn’t your fault and a fault claim is where it was? Almost. But that’s not the full story.

Ultimately, these terms aren’t really to do with who was at fault. It’s about who pays.

If somebody crashed into you because they were texting while driving, that would clearly be their fault. The costs would be recovered from their insurer and, as far as you’re concerned, that would go down as a no-fault claim.

Now imagine the exact same thing happened only the other driver was, as well as being a bit clumsy, a real scumbag too. After hitting you, they just speed off. There were no witnesses and you didn’t catch their number plate.

Chances are you’ll never track them down, let alone get their insurance details. As a result, your insurer will be the one paying to get your car fixed. That means – even though it wasn’t technically your fault – it will go down as a ‘fault’ claim.

FCA

The FCA is the Financial Conduct Authority. It’s the regulatory body that oversees UK insurers, working to make sure the market is competitive and fair.

If you have a problem with an insurer though, it’s normally the Financial Ombudsman that can help you resolve it.

Fully comprehensive

It would be fair to assume that this refers to a level of insurance that’s even higher than comprehensive. As is often the way with assumptions, that would be wrong.

‘Comprehensive’ and ‘fully comprehensive’ are just two ways of saying the same thing.

I

Indemnity

It sounds like a good name for a late 90s courtroom drama, but what does it mean?

An ‘indemnity’ is an agreement where one party agrees to compensate another in the event of a specific kind of loss. That still sounds vague, so let’s put it in context:

When we insure you, we’re making the promise to cover the cost if your car gets damaged. That’s an indemnity. Not as dramatic as it sounded…

Insurable interest

If you’d suffer as a direct result of an object getting damaged, you have an ‘insurable interest’ in that object. In order to take out valid cover for a car, you must have a clear insurable interest in it – owning it is normally seen as pretty good evidence of this.

The rule about needing an ‘insurable interest’ seems pointless until you think what would be possible if they didn’t exist. Insurance would become a kind of gambling. You’d have no insurable interest in someone else’s car that lives 20 streets away from you. If you insured it, you’d basically be wagering that something untoward was going to happen to it… which is a bit weird.

Insurable value

This means the amount your car is worth in your insurer’s eyes. To put it another way, it’s the amount they’d pay out if your car was totalled.

Insurers, intermediaries and brokers

The company you deal with in buying, arranging and managing your insurance isn’t always the insurers themselves (the insurers being the one who actually underwrites the policy and puts forward the money to pay out claims). Your insurance provider could be what’s known as a ‘broker’ or an ‘intermediary’.

By Miles is an insurance intermediary or MGA (Managing General Agent). The policies we sell are underwritten by a panel of insurers, including U K Insurance.

Insurance Premium Tax (IPT)

If you’ve seen the word ‘tax’ and started panicking, don’t worry, the price you normally see from your insurer will normally already include IPT as part of the total cost. Insurance Premium Tax (also known as IPT) is added to insurance premiums by law instead of VAT. It’s set and controlled by the UK Government.

L

Lapse

This is short for ‘lapse in coverage’. It’s when your policy stops covering you. For example, if you stopped paying your premiums or didn’t renew your policy at the end of its expiry date, your policy would lapse and you wouldn’t be able to claim.

Legal owner

This one’s pretty straightforward, it’s the person the car legally belongs to. Bear in mind, you don’t have to pay for the car to be the legal owner – you could be given it as a gift.

Levels of cover

In the UK you’re legally required to have at least ‘third-party’ car insurance. This covers injury to your passengers as well as damage you might do to other people and their property. Your car itself isn’t covered, so if someone rear ends you, bad luck – it’s down to you to get that fixed.

One level up from this there’s ‘third party, fire and theft’. This adds cover for your vehicle if it’s stolen or involved in a fire – but not road accidents. If you want to protect yourself against those you need ‘comprehensive’ insurance.

Limit

A policy will usually put a cap on how much your insurer will pay out over a set period of time. There may be a limit on how much you can claim over a year.

Equally, there could be a limit on how much the insurer will pay per individual incident.

Loss adjuster

Also known as ‘claims adjusters’, these impartial professionals are used in the case of complicated claims. They’ll investigate what happened and – given the terms of the policy – decide on a fair outcome.

Though they’re independent, their fees are paid for by the insurer.

M

Miles Tracker

The Miles Tracker is the name of the telematics device we use to (you guessed it) track the miles our customers drive.

Given that we charge on a pay-by-mile basis, it’s a really important part of what we do – but it does more than just track miles.

The Miles Tracker can let us know if you’ve been in an accident and need help and track your car’s location if it’s stolen. It can also scan your car’s diagnostics systems and alert you to mechanical problems. When it comes to preparing for your MOT this can be a huge bonus.

Misrepresentation

This is just a fancy word for a lie. If you include a ‘misrepresentation’ in the information you provide your insurer, your coverage may be void.

The best thing you can do to try and avoid this is to make sure you fill in your details carefully when you fill out your insurance quote.

MTA

This stands for ‘Mid-Term Adjustment’. It’s where you change the details in your policy after it’s been issued. (For example, if you moved house, you’d need an MTA to put the new address on your policy).

An MTA may result in additional premiums.

N

New for old

This is where an insurer agrees to replace your insured item with a new equivalent – even if the one you owned was older. In the context of car insurance, this would mean that if you wrote off your car, you’d receive a new one of the same model or similar.

In most cases this will only be offered as an option if the car you’re insuring is brand new (it’s also known as ‘new car replacement cover’). The offer will normally expire after a year or two and will only apply if your car is a total loss. So, before you get this kind of cover, you need to know what your insurer considers a total loss to be…

Usually, if the cost of repairs were 60% of your car’s market value or higher, it would go down as a write off – but the percentage could be higher. Basically, the higher the cost of your repairs, the more likely you are to benefit from ‘new for old’ cover.

No claims discount (NCD) or bonus (NCB)

Some insurers love older drivers, some prefer younger drivers, some specialist insurers only cover classic cars – By Miles is about low mileage drivers. But there’s one trait all insurers are into: carefulness. And No Claims Discounts exist to reward those who are extra safe on the roads.

Each year you avoid making a claim adds to your No Claims Bonus. After five years of no claims, you should be looking at some pretty good savings.

If you do need to make a claim, the good news is that you don’t reset at zero – usually you’ll have two years knocked off the number you’d accumulated.

The good news is that every By Miles policy comes with a No Claims Discount guarantee.

No Claims Bonus protection or No Claims Discount guarantee

Your No Claims Bonus is precious – and, as well as insuring your car, some insurers will offer to protect your No Claims as well. This means that, if you did make a claim, your bonus wouldn’t be affected.

It’s important to remember that this isn’t the same as freezing your premiums. If you were in a crash and had to claim, your premiums would probably go up.

As we point out in this article, extra protection for your No Claims Bonus with another insurer may not always be worth actually paying for.

That’s why we throw in a No Claims Discount guarantee for free with every By Miles policy, so if you’re with us, your No Claims Discount will never go down – even if you have a claim while you’re with us (again, we should repeat that this doesn’t mean your premium is frozen – it still may go up if you make a claim, but it does mean your NCD will stay put).

Non-disclosure

This where you fail to tell your insurer something they’re supposed to know. Non-disclosure could invalidate your insurance.

P

Pay-per-mile insurance

Also known as pay-by-mile, pay as you go, pay as you drive or usage-based car insurance, this is where your insurer charges you using a per-mile rate.

Being a pay-per-mile insurance provider ourselves, we have a fair bit to say on the subject. You can get the full low down on pay-per-mile car insurance here.

Policy

Your policy is made up of a range of documents that set out all the specific terms and conditions of your insurance.

Policyholder

This is the person that owns the insurance. Note that you could be insured by a policy without being the policyholder, i.e. as a named driver.

When a claim is made the payout would always go to the policyholder.

Policy term

This is the length of time your insurance will cover you – which is usually 12 months unless you’re buying short-term or temporary car insurance.

Premium

‘Premiums’ are the money you pay to your insurer to offer you insurance cover – in other words: your bills.

Pre-existing medical conditions

This refers to any sort of medical condition you have prior to taking out an insurance policy. Insurers will need to you to tell them about anything that might impact on your driving (epilepsy, for example).

Withholding information about a condition could be considered ‘non-disclosure’ and may invalidate your insurance. If you’re not sure what to include here, take a look at the DVLA’s list of conditions on their website.

Proposal form

This is the form the insurer will ask you to fill in before making a decision on whether to insure you. It’ll ask for all the information they need to accept you and set a premium.

Pro rata rates

Latin again! This means ‘according to the rate’. In insurance terms this is where – in the event that you cancel a policy – you aren’t charged for the full term. Instead, you pay a ‘pro rata’ rate covering the time you actually used your cover.

We think this is the fairest way of doing things. It’s how we deal with customers who decide they want to go elsewhere. But look out – not all insurers feel the same way.

Q

Quote

This has nothing to do with rattling off lines from long-dead authors or motivational phrases from celebrities. In insurance, a ‘quote’ is simply when an insurer tells you how much they will charge you if you buy their insurance.

R

Rating

Insurance is all about risk. To gauge how much of a risk any potential customer might be, insurers will take all the information from their proposal forms, compare it to the data they have on previous customers and come up with a kind of score for how risky the individual seems. This score is the rating.

Ratings are a tried and tested method for insurers, but they come with a healthy dose of unfairness. If you’re 18 or if you drive a sports car – even if you’re the safest driver in the world – those factors will almost certainly have a negative impact on your rating. Basically, you’ll be punished for the mistakes of people who fit a similar profile to you.

At By Miles we like to think we help put some control back into the hands of our members. Yes, we still use rating factors, but we charge you by the mile – and how far you drive is entirely in your hands. Better yet, it means your premiums are rooted in measurable facts about your driving – not just stereotypes.

Registered keeper

The registered keeper is the person whose name appears in the car’s log book (V5C registration document).

This could be different from the owner (the person the car belongs to) or the main driver (the person named in the policy as making most use of the car).

Renewal

If you’re happy with your insurer and want to stay with them, you can renew your policy when it comes to an end. Bear in mind that many insurers don’t go out of their way to reward loyalty, so it pays to at least look around before renewing.

Renewal notice

Given that many people (not us) have been known to forget loved ones’ birthdays, expecting folks to remember when their insurance is going to end is a bit of an ask.

To make sure you aren’t caught off guard, your insurer will send you a note three or four weeks before this happens telling you that your policy is set to renew and what premiums you’ll be paying.

If you don’t like what you see, this is the time to shop around, cancel and move. If you don’t do so in time, your policy could auto-renew.

Risk

In insurance, the ‘risk’ means the event or events you’re insuring against.

S

Social, domestic and pleasure (SD&P)

Insurers will want to know what you use your car for before offering a quote. One of the options you’ll be able to provide as a response will be ‘social, domestic and pleasure’ (SD&P).

Most car usage falls under this umbrella. Visiting a mate? That’s social. School run? That’s domestic. Road trip? That’s pleasure. Driving to work? That’s commuting, and it wouldn’t be covered by an SD&P policy. Driving to see a customer? That’s business.

At By Miles we like to keep it simple – we’ll always offer you the best level of coverage we possibly can. You’ll need to check your own quote to see exactly what we can give you, but we’ll try and include as much as possible, up to social, domestic, pleasure and commuting for all drivers, with the main driver covered for driving for business use.

SORN

SORN stands for Statutory Off Road Notice. You can use one to let the DVLA know if your car is out of use. Once you have, you’ll no longer have to insure or tax it while it’s kept off public roads.

T

Telematics

‘Telematics’ refers to technology insurers can use to collect data about their customers’ driving habits – information they use to create personalised premiums.

Our Miles Tracker is an example of a telematics device – and we offer telematics insurance policies. That said, we’re not a typical one. That’s because we use our technology to measure how far our customers drive and charge them on a per-mile basis – a very simple equation.

Other insurers use all kinds of different data – along with their own mysterious algorithms – to make judgements on how ‘well’ they feel people drive.

We think our straightforward approach is fairer. You can find more details on why that is, here.

Third party

Also sometimes referred to as ‘third party only’ (TPO), third party insurance is the legal minimum level of coverage you need to drive in the UK.

See ‘Levels of cover’ above for a full definition.

Third party fire and theft

This is one level up from third party only insurance and one below comprehensive. For details of what’s covered, see ‘Levels of cover’ above.

U

Underwriter

The ‘underwriter’ is the party who actually takes on the risk in an insurance arrangement. In the case of By Miles, our policies are underwritten by a panel of insurers, including U K Insurance.

Phew…

We made it to the end of the alphabet! (Apologies to V, W, X, Y, Z and any other letters that didn’t get a look in).

Hopefully you’re feeling like you can now dive into your insurance documentation knowing exactly what’s what. That’s important, because it’s vital that you read it through.

If you’re with By Miles, rest assured that we try to make all our communications as straightforward as possible. If you do spot something that isn’t clear, please let us know. Our member support team are always happy to explain things, or you can tweet us your questions.

Oh, and if you think there’s a term we’ve missed, just point it out and we’ll add it. (Especially if it starts with the letters V, W, X, Y or Z)